The financial world is evolving rapidly with the growth of digital assets like cryptocurrencies, stablecoins, and NFTs (Non-Fungible Tokens). With these changes come new crypto tax responsibilities, highlighted by the introduction of the IRS Form 1099-DA, slated for implementation in 2025. Accountit, CPA is here to guide you through these changes with ease and confidence.

What Are Cryptocurrencies, Stablecoins, and NFTs?

- Cryptocurrencies are digital or virtual currencies secured by cryptography. They operate on decentralized blockchain technology, ensuring secure, immutable transactions. Bitcoin and Ethereum are prominent examples. Learn more about cryptocurrencies at Investopedia: and IRS guidance on virtual currencies.

- Stablecoins aim to maintain stable values by being pegged to traditional currencies like the U.S. dollar, minimizing the volatility typically associated with cryptocurrencies. More details can be found at the Consumer Financial Protection Bureau.

- NFTs represent ownership of unique digital items and are used to buy and sell digital art, music, and more. Unlike cryptocurrencies, each NFT is distinct and cannot be exchanged on a one-to-one basis like cash. The IRS FAQs provide additional information.

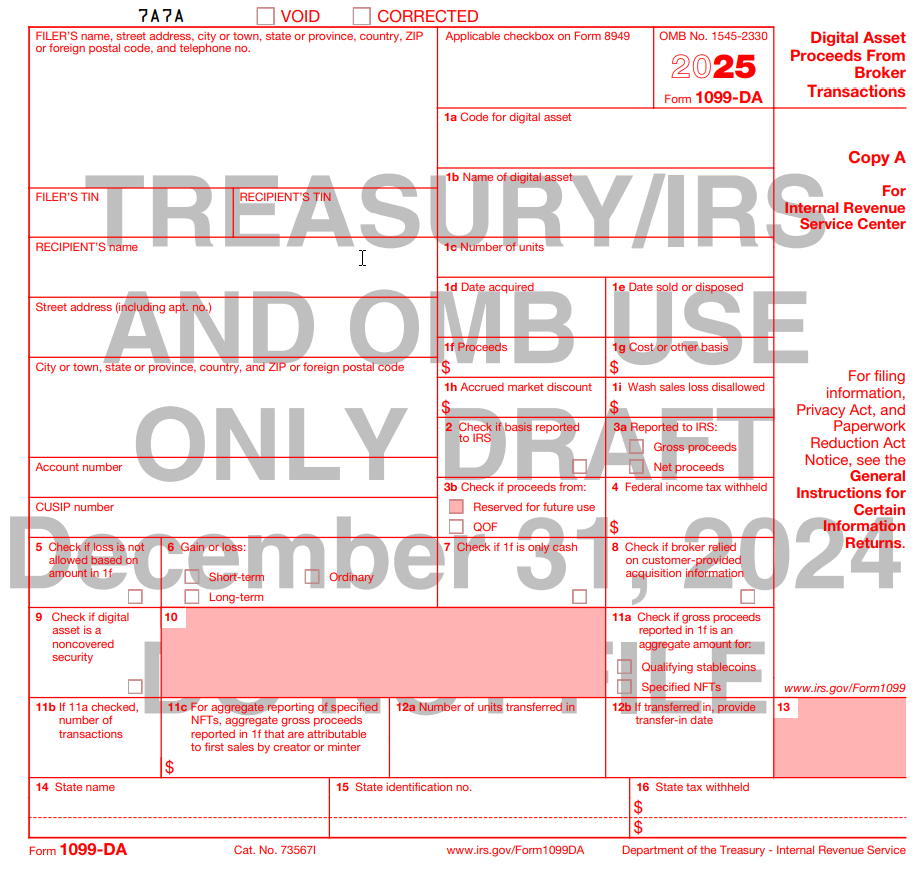

Understanding Form 1099-DA

Form 1099-DA is a new requirement for digital asset brokers to report transactions involving digital assets. The form will enhance transparency and ensure crypto tax compliance, with brokers needing to start using this form in 2025, and the first reports due in 2026. The IRS provides a draft of this form.

Key Differences Between Form 1099-DA and Traditional 1099s:

- Unique Identification Needs: Unlike the 1099-B used for stocks, Form 1099-DA requires a unique identification code for each digital asset, reflecting the unique nature of each cryptocurrency and NFT.

- Complexity of Transactions: The extreme volatility and diverse use cases of cryptocurrencies as both investments and mediums of exchange create a complex tax reporting landscape. This includes challenges from blockchain events like hard forks and airdrops.

- Decentralization and Rapid Evolution: The decentralized nature of many digital asset platforms and the fast pace of the crypto space make tracking and reporting significantly more challenging than with traditional financial instruments.

- Global Nature and IRS Classification: The worldwide scope of crypto transactions and the IRS’s classification of digital assets as property, not currency, necessitate a specialized form.

Special Considerations for Stablecoins and NFTs

- Stablecoins: Transactions involving qualifying stablecoins with total annual transactions not exceeding $10,000 are exempt from reporting, as noted in IRS Notice 2024-21.

- NFTs: The IRS allows brokers to use an alternative reporting method for NFT transactions if the total gross proceeds do not exceed $600 annually, according to IRS Notice 2024-59.

Addressing Privacy Concerns

Privacy is a crucial concern in the cryptocurrency community. The IRS has clarified that their interest is solely in the financial outcomes of transactions. They are not seeking access to private keys or seed phrases but are focused on ensuring that all taxable events related to digital assets are properly reported. More details are available on the IRS Virtual Currency Compliance campaign page.

How Accountit, CPA can assist?

Navigating the complexities of digital asset taxation can be daunting. Accountit, CPA offers comprehensive support:

- Compliance Assurance: We ensure that your reporting is accurate and compliant with new regulations.

- Educational Guidance: We help you understand the implications of new tax forms and digital asset transactions.

- Strategic Planning: We provide advice on structuring your transactions to minimize tax liabilities effectively.

Conclusion

The introduction of Form 1099-DA is a significant development in the regulation of digital assets. With the expertise of Accountit, CPA, you can confidently navigate these changes, ensuring that your digital asset transactions are compliant and optimized for crypto tax purposes. Contact us today to prepare for the future of digital finance securely and successfully.